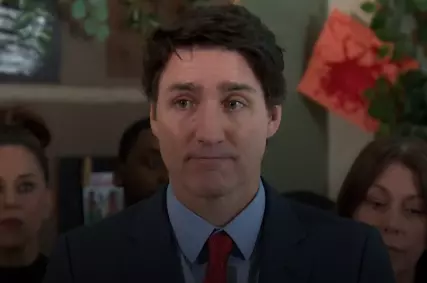

U.S Tarrifs - Trudeau’s Response Will Impact the Canadian Real Estate Market

The trade war between Canada and the U.S. has intensified, with Prime Minister Justin Trudeau taking a firm stance against the latest round of American tariffs. While Canada refuses to back down, these economic policies are already influencing inflation, interest rates, and the housing market in cities like Milton and Mississauga. If you're a homeowner, buyer, or investor, understanding these dynamics is crucial for making informed decisions in the months ahead.

Trudeau’s Response to U.S. Tariffs

On March 6, 2025, Prime Minister Justin Trudeau reaffirmed Canada's commitment to retaliatory tariffs, despite the U.S. granting a temporary suspension for certain sectors. His key message? Canada will not ease its economic countermeasures until the U.S. fully rescinds its tariffs.

🔹 Canadian Tariffs Remain in Place – The 25% tariff on U.S. goods will continue as a direct response to U.S. duties on Canadian imports, including a 10% tariff on Canadian energy exports. Trudeau made it clear that Canada is willing to fight for fair trade.

🔹 Weakening Canadian Dollar – With rising trade tensions, the Canadian dollar has depreciated against the U.S. dollar, which has a direct impact on the price of imported goods, including building materials for real estate.

🔹 Trade War Could Last for the Foreseeable Future – Trudeau acknowledged that this economic conflict is far from over and that Canada must brace itself for prolonged uncertainty in international trade relations.

But what does this mean for homeowners, buyers, and real estate investors? Let's dive deeper.

How Tariffs Are Influencing the Canadian Real Estate Market

1. Rising Costs of Home Construction and Renovations

The real estate sector is heavily dependent on materials sourced from the U.S., including lumber, steel, and appliances. With tariffs driving up import costs, builders and renovators will face higher expenses, potentially leading to:

-

Slower home construction – Developers may scale back new projects, reducing the housing supply.

-

More expensive home prices – The increased cost of materials may be passed on to buyers, making homes less affordable.

-

Higher renovation costs – Homeowners looking to renovate will likely see a jump in prices for materials and labor.

2. Interest Rate Uncertainty: Will the Bank of Canada Lower Rates?

With economic uncertainty growing, all eyes are on the Bank of Canada’s interest rate decision on March 12. The BoC has two possible paths:

✔️ If interest rates are lowered:

-

Mortgage rates will drop, making it cheaper for buyers to finance homes.

-

This could spark a surge in homebuyers, increasing competition in the market.

-

Prices in Milton and Mississauga could rise due to demand outweighing supply.

❌ If rates remain the same or increase:

-

Borrowing will stay expensive, potentially reducing buyer demand.

-

Inflation concerns from rising construction costs may force the BoC to keep rates steady or even hike them, slowing home sales.

The decision on March 12 will be a key indicator of how the real estate market will shift in the coming months.

3. Housing Demand in Milton & Mississauga

Milton and Mississauga have been among the fastest-growing real estate markets in the GTA. With a strong demand for detached homes, condos, and townhouses, any fluctuations in interest rates or home prices will have immediate effects on these markets:

-

If mortgage rates drop, buyer demand will increase, leading to potential price hikes.

-

If construction slows due to tariffs, fewer new homes will be available, further driving up resale home prices.

-

First-time buyers may find it even harder to afford a home if supply shrinks while demand remains strong.

What Should Buyers & Sellers Do Now?

🔹 Buyers: If you're planning to purchase a home, keep a close watch on the March 12 interest rate decision. Lower rates could mean locking in a mortgage at more affordable terms, but waiting too long might result in increased home prices.

🔹 Sellers: If demand rises due to lower mortgage rates, it could be the perfect time to list your home. More buyers in the market typically mean higher selling prices and multiple-offer scenarios.

🔹 Investors: With economic uncertainty looming, real estate remains a hedge against inflation. Investing in properties now could help secure assets before price increases make the market even more competitive.

Final Thoughts: Stay Informed & Plan Ahead

The U.S.-Canada trade war is far from over, and its effects will continue to shape the real estate market in Milton, Mississauga, and across the GTA. Whether you're looking to buy, sell, or invest, staying informed on policy changes and market trends is key to making the best financial decisions.

If you have questions about how these changes impact your real estate plans, let’s connect! I'm here to help you navigate this evolving market with confidence.

📩 victoriahillierhomes@gmail.com

4163003724

Categories

Recent Posts