Mortgage Loan Insurance - CMHC - What is it, and What's New?

What is Mortgage Loan Insurance?

Mortgage loan insurance is typically required by lenders when homebuyers make a down payment of less than 20% of the purchase price. Mortgage loan insurance helps protect lenders against mortgage default, and enables consumers to purchase homes with a minimum down payment starting at 5%* — with interest rates comparable to those offered with a larger down payment. To obtain mortgage loan insurance, lenders pay an insurance premium.

Typically, your lender will pass this cost on to you. The premium is based on the loan-to-value ratio (mortgage loan amount divided by the purchase price). The premium can be paid in a single lump sum or it can be added to your mortgage and included in your monthly payments.

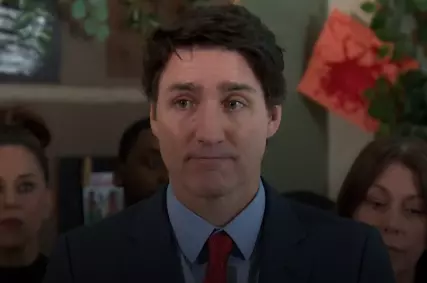

Exciting News: Major Mortgage Changes Coming Soon!

If you've been keeping an eye on the real estate market, you're in for some great news! The Canadian government has just announced significant changes to mortgage regulations that could make it easier for you to buy your dream home, especially if you're in a high-priced housing market.

What's New?

-

Increased Insured Mortgage Limit

The insured mortgage limit has been raised from $1 million to $1.5 million. This means you can now secure mortgage insurance on higher-priced homes with a lower down payment. For example, if you’re looking at a $1.5 million property, you could potentially put down just $125,000 instead of the previous $300,000. This increase in the insured mortgage limit opens up new possibilities for many buyers who have been eyeing homes in the higher price range.

-

Extended 30-Year Amortizations

In addition to raising the insured mortgage limit, the government is now allowing 30-year amortization periods for all first-time homebuyers. This extended amortization period can significantly reduce your monthly mortgage payments, making homeownership more affordable. Previously, 30-year amortizations were only available for first-time buyers purchasing newly built homes. Now, all first-time buyers can benefit from this extended term regardless of the property type.

What Does This Mean For Those Looking To Buy?

These changes are designed to make homeownership more accessible and reduce the financial strain of monthly mortgage payments. If you’ve been considering purchasing a home but were concerned about the high down payment requirements or the impact of monthly payments, these new rules could be a game-changer.

With the increased mortgage limit and the option for longer amortization periods, you might find that you’re now able to afford a home that was previously out of reach. This is a fantastic opportunity to reassess your home-buying plans and take advantage of the new, more favorable conditions.

Should You Rush To Purchase?

Buying your first home should never be instigated by market trends. The perfect time to buy is always when you feel you are ready to make the move. But, if you have been waiting on the sidelines for an opportunity to get into ownership, the new changes are advantageous in several ways!

Categories

Recent Posts